avtoelektrik18.ru Community

Community

Cost Of Central Ac

This means an AC unit could cost you from $ to $ per day to run. Or about $$ per month you're running it. Let's say you still have an ideal home. As we mentioned earlier, you can expect to pay anywhere from $7, to $18, for a central AC unit, including installation. Ductless Mini-Split Systems. If. While I don't have real-time pricing information, a quote of $14, for a sqft home including both the AC and furnace could be reasonable. Factors Affecting the Price. The average cost of replacing the central air conditioning in a home is between $3, and $7, The smallest, most budget. Your choice of AC system significantly impacts cost; central AC systems present a higher initial investment but deliver comprehensive cooling, whereas window. Average cost to install central air conditioning is about $ (central A/C cool only for avtoelektrik18.ru - upgraded). Find here detailed information about. On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit. Installing central air conditioning costs, on average, between $4, and $8, but can go up to $12,, depending on the unit you purchase and its. The national average to install a brand new central air conditioning unit is $5,, with the typical price tag range of $3, to $7, Central AC unit costs. This means an AC unit could cost you from $ to $ per day to run. Or about $$ per month you're running it. Let's say you still have an ideal home. As we mentioned earlier, you can expect to pay anywhere from $7, to $18, for a central AC unit, including installation. Ductless Mini-Split Systems. If. While I don't have real-time pricing information, a quote of $14, for a sqft home including both the AC and furnace could be reasonable. Factors Affecting the Price. The average cost of replacing the central air conditioning in a home is between $3, and $7, The smallest, most budget. Your choice of AC system significantly impacts cost; central AC systems present a higher initial investment but deliver comprehensive cooling, whereas window. Average cost to install central air conditioning is about $ (central A/C cool only for avtoelektrik18.ru - upgraded). Find here detailed information about. On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit. Installing central air conditioning costs, on average, between $4, and $8, but can go up to $12,, depending on the unit you purchase and its. The national average to install a brand new central air conditioning unit is $5,, with the typical price tag range of $3, to $7, Central AC unit costs.

Central AC Installation Cost. Central AC unit costs range from $3, to $7, GET ESTIMATE.

A central AC unit install can range from $ to $ However, several factors go into the price which you can review before receiving an estimate. The cost of installing a central air conditioning in your home can vary depending on a lot of factors. Here is what you should consider. Average Central AC for a sq. ft. home, costs around $6, for a 18 SEER model, and $5, for a 14 SEER model. Main difference between lower and higher. Basic builder grade system $ When considering the cost of a 2-ton central AC unit, it's important to understand the range of central air. Homeowners pay an average of $5, to $10, for a central air conditioner unit, including professional installation.* The main factors that affect AC unit. The average cost of installing a central AC or a heating system can range between $4, - $12, Energy efficiency. When upgrading your AC, consider. It also depends upon the type of system. Carrier air conditioners, for example, offer a variety of energy efficiency or SEER2* ratings, various types of comfort. Investing between $4, -$12, for an efficient Central Air Conditioner system. The installation and replacement costs cover only the central AC unit and. The estimated labor cost to install central air with existing ductwork is $1, to $3, for installing the AC with the lines and pad. Add approximately $ Find central air conditioners at Lowe's today. Shop central air conditioners and a variety of heating & cooling products online at avtoelektrik18.ru The average cost of central air conditioning installation ranges from $5, to $12, in New Jersey. Meanwhile, replacement costs including labor can range. You can expect to pay an average of $5, for AC replacement costs. Most homeowners pay between $3, and $7,, with your actual costs depending on the. Installing central AC is a way to stand out in the luxury rental market. Expect to pay $ for a four-story building with ducted units in the. Factors Affecting the Price. The average cost of replacing the central air conditioning in a home is between $3, and $7, The smallest, most budget. Find out how much it costs to install a new air conditioner, furnace, boiler, heat pump, or other residential HVAC system in your home. The average HVAC Replacement Cost will run between $ to $ Find out the ins and outs of HVAC System Cost in minutes. A new central air conditioning installation cost can be $ – $ in Colorado Springs. Many homes in the area are not equipped with. New HVAC System Cost · Electric furnace: $2,–$3, · Gas furnace: $3,–$4, · Ductless split AC: $3,–$5, · Oil furnace: $5,–$8, · Central AC. Get It Fast · Availability · Department · Review Rating · Brand · Price · BTU Cooling Rating (Btu/h) · Noise Level.

Is It Hard To Start Your Own Clothing Line

Knowing that, it's hard not to wonder what it would take to start your own clothing business from home. Fortunately, it's not as complex as you might think, it. Learning how to start a clothing brand is tough. Be sure to join the insider What is a Limited Liability Company (LLC) and How To Start Your Own Business. Starting a clothing line is no easy feat. But there's nothing quite like bringing your own designs to market! After starting a business, promoting and operating. **Lower overhead costs:**Opening a brick-and-mortar store can cost between $50, to $,, while most online clothing business models require substantially. However, success in the retail clothing industry requires motivation, hard work and a solid action plan. You can even create your own clothing brand as a. Starting a clothing line is a dream business plan of many fashion lovers and entrepreneurs of every age. With a unique branding strategy and market research. Yes it's possible, there's a boy in my year who's had his own clothing line since he was 12 or something maybe younger. If you have ideas go for. Designing your clothing line can be challenging. There are many aspects to think of to make it stand out in a crowded fashion market. You want to create clothes. This means a clothing business must either invest in their own equipment or work with an existing clothing manufacturer to produce their clothing lines. Working. Knowing that, it's hard not to wonder what it would take to start your own clothing business from home. Fortunately, it's not as complex as you might think, it. Learning how to start a clothing brand is tough. Be sure to join the insider What is a Limited Liability Company (LLC) and How To Start Your Own Business. Starting a clothing line is no easy feat. But there's nothing quite like bringing your own designs to market! After starting a business, promoting and operating. **Lower overhead costs:**Opening a brick-and-mortar store can cost between $50, to $,, while most online clothing business models require substantially. However, success in the retail clothing industry requires motivation, hard work and a solid action plan. You can even create your own clothing brand as a. Starting a clothing line is a dream business plan of many fashion lovers and entrepreneurs of every age. With a unique branding strategy and market research. Yes it's possible, there's a boy in my year who's had his own clothing line since he was 12 or something maybe younger. If you have ideas go for. Designing your clothing line can be challenging. There are many aspects to think of to make it stand out in a crowded fashion market. You want to create clothes. This means a clothing business must either invest in their own equipment or work with an existing clothing manufacturer to produce their clothing lines. Working.

Learning how to start a clothing brand is tough. Be sure to join the insider What is a Limited Liability Company (LLC) and How To Start Your Own Business. Finding a talented clothing manufacturer to make your line can be a challenge. The reason being is the manufacturer(s) that you decide to go forward with making. Thinking about starting a clothing line? It will fail. They always fail. Do not waste your money and time. Starting a clothing line requires a solid grasp of the fashion industry, which is vast and complex. It involves numerous steps from the initial design concept. Although launching one's own clothing line is challenging, thanks to the promotion of e-commerce and online marketing, it is possible to turn a. The average cost to start an online clothing line spans anywhere between $5,$17,, and for a large retail clothing line business it ranges between $64, Starting a clothing line with no money can be difficult, but it's not impossible. You can create a successful brand without spending a dime on marketing with. Are you passionate about fashion and dreamed of starting your own clothing line? Launching a fashion brand can be an exciting journey filled. You are your own boss and you need to make it all happen. You will live and breathe your clothing brand, working 24/7. Everyone has great ideas. The difference. Starting a clothing line is no simple task; it takes both creativity and business acumen to make the brand work and turn a profit. A creative flair will. What matters is what you produce. You are your own boss and you need to make it all happen. You will live and breathe your clothing brand, working 24/7. Starting a clothing brand is all about freedom. When you start your own brand, you're free to express yourself artistically and make your own choices. Starting. Finding a talented clothing manufacturer to make your line can be a challenge. The reason being is the manufacturer(s) that you decide to go forward with making. 1. Do your research · 2. Create a business plan · 3. Choose a name and brand identity · 4. Find A Manufacturer · 5. Create a marketing plan · 6. Launch your clothing. Identifying your market by seeing what is missing from the clothing industry is an essential aspect of starting your own clothing line. It's difficult to stand. Starting your own clothing line and successful brand requires dedication, hard work and patience. By avoiding these 10 pitfalls and common mistakes made by. start their own clothing lines with minimal risk and investment. we Thank you all for your hard work and excellent quality clothing! beiged fun. When you take a risk – like starting a fashion business, showing your product line, putting yourself out there – stuff's gonna happen. Period. Pursuing your dream of starting a clothing line can be difficult without a lot of money, but it is possible! To start, figure out how much startup capital.

Get Courses For Free

Browse hundreds of free short courses written by Open University academics. Study at your own pace and earn digital badges and certificates. Transform your resume into a powerful tool that will get you noticed in a competitive job market. Ready. This free online course from Harvard Kennedy School introduces approaches to analytical decision-making for policy design. Price. Free*. Registration Deadline. Discover over free online courses across a wide range of categories at Alison®. Enroll today and start earning valuable certificates and degrees. Take online courses from the world's top universities for free. Below, you will find free online courses from universities like Yale, MIT, Harvard. How To Get A free Certificate · Create a free account:from here · Choose Your Learning Track:Here · You can Join More than One Course · After you enter the course. All OpenLearn courses are free to study. We offer nearly free courses across 8 different subject areas. Our courses are available to start right away. Explore new and trending free online courses · Prompt Engineering for ChatGPT · Getting Started with Gemini (Bard) · Generative AI for beginners · ChatGPT for. From data science and computer programming to the humanities, our free online courses serve the evolving needs of tomorrow's job market. Browse hundreds of free short courses written by Open University academics. Study at your own pace and earn digital badges and certificates. Transform your resume into a powerful tool that will get you noticed in a competitive job market. Ready. This free online course from Harvard Kennedy School introduces approaches to analytical decision-making for policy design. Price. Free*. Registration Deadline. Discover over free online courses across a wide range of categories at Alison®. Enroll today and start earning valuable certificates and degrees. Take online courses from the world's top universities for free. Below, you will find free online courses from universities like Yale, MIT, Harvard. How To Get A free Certificate · Create a free account:from here · Choose Your Learning Track:Here · You can Join More than One Course · After you enter the course. All OpenLearn courses are free to study. We offer nearly free courses across 8 different subject areas. Our courses are available to start right away. Explore new and trending free online courses · Prompt Engineering for ChatGPT · Getting Started with Gemini (Bard) · Generative AI for beginners · ChatGPT for. From data science and computer programming to the humanities, our free online courses serve the evolving needs of tomorrow's job market.

Class Central aggregates courses from many providers to help you find the best courses on almost any subject, wherever they exist. Find more free online learning courses · Accenture · Barclays Lifeskills · Barclays Digital Eagles · LinkedIn Learning - some free introductory courses. avtoelektrik18.ru is Free and you can test the platform quickly with your real content! Get started for free! We offer a number of free courses to suit a wide variety of passions and career paths. Choose one or choose them all — there's no limit to what you can learn. 1. **Coursera:** Offers free courses from universities and organizations. · 2. **edX:** Provides free online courses from universities around. Want to find in-demand jobs or get ahead in your career? Expand your skills with online free skills training developed by Google. Discover thousands of offerings — from free courses to full degrees — delivered by world-class partners like Harvard, Google, Amazon and more. The most popular courses on our platform that are fully accessible without payment. Learn online and earn valuable credentials from top universities like. Free courses from Udemy to help you make the most of your time, from working at home to trending technical skills and self-improvement, wherever you are. Most of these courses are entirely free, while some may come with a free trial period. We hope this helps you make the most of your time while also keeping you. Coursera has some completely free courses (most of them not so popular or from fancy institutions). Most of them have a 7-day free trial and then you need to. Our free online courses provide you with an affordable and flexible way to learn new skills and study new and emerging topics. Get on the fast track to in-demand jobs with top employers. Complete a Google Career Certificate to get exclusive access to CareerCircle, which offers free 1. Our certificates are absolutely free to study, and upon completion, you can choose to download an official certificate as proof of your achievement. Unlike. To access these free courses, simply visit the Udemy Free Resource Center at avtoelektrik18.ru Browse through the available. SkillUp is a learning platform from Simplilearn where learners can take free online courses. All of the self-learning courses are free of cost. Free Online Courses With Certificates. Oxford Home Study Centre offers Free Online Courses Enrolment is quick and easy, making now the perfect time to get. Explore a free library of MIT courses, material, and curriculum from MIT OpenCourseWare education professionals find and use OCW content in their classrooms. While Coursera, edX, Udemy, Google and Great Learning offers loads of free online courses with certificates, do have a look at Alison, NPTEL and. PWSkills Decode Java with DSA Course - March'24 See if your local library has a subscription to udemy, if so you can get access to all the.

What Is The Best Prepaid Credit Card To Build Credit

Extra is the first debit card that helps you build your credit and earns up to 1% back in points for everyday purchases like gas, coffee and your phone bills. The difference is that it requires a cash security deposit that the lender “holds” to secure the funds. They're an ideal way for people to build credit or. They can't, however, help you build up your credit score. Traditional credit cards could be a better option for your finances if you are looking to build your. The prepaid debit cards are not credit cards. Browse Card Categories. Review featured cards from our partners below. Advertiser Disclosure. Get one of our prepaid credit cards. Load it with your own money, use it anywhere Mastercard is accepted, and pay no interest. The Chime Credit Builder Visa card is good for those who want to build credit but don't want to be bound by minimum deposits. Annual Fee, None. Security deposit. Typically, using prepaid credit cards won't help you build credit. However, KOHO prepaid cards are different. Similar to how secured credit cards work, prepaid business credit cards build credit establish good habits that your card issuer shares with credit reporting. The best credit card for building credit is the Discover it® Secured Credit Card because you won't have to pay an annual fee, it has good rewards and it. Extra is the first debit card that helps you build your credit and earns up to 1% back in points for everyday purchases like gas, coffee and your phone bills. The difference is that it requires a cash security deposit that the lender “holds” to secure the funds. They're an ideal way for people to build credit or. They can't, however, help you build up your credit score. Traditional credit cards could be a better option for your finances if you are looking to build your. The prepaid debit cards are not credit cards. Browse Card Categories. Review featured cards from our partners below. Advertiser Disclosure. Get one of our prepaid credit cards. Load it with your own money, use it anywhere Mastercard is accepted, and pay no interest. The Chime Credit Builder Visa card is good for those who want to build credit but don't want to be bound by minimum deposits. Annual Fee, None. Security deposit. Typically, using prepaid credit cards won't help you build credit. However, KOHO prepaid cards are different. Similar to how secured credit cards work, prepaid business credit cards build credit establish good habits that your card issuer shares with credit reporting. The best credit card for building credit is the Discover it® Secured Credit Card because you won't have to pay an annual fee, it has good rewards and it.

U.S. Bank Secured Visa® Card: Best feature: Interest-earning security deposit. Capital One Quicksilver Secured Cash Rewards Credit Card: Best feature: Flat-rate. It allows you to build credit as you earn cash back rewards. The card's lack of setup and maintenance fees make it the best credit card in this review for. building your credit history with responsible use Compare Truist Visa® credit cards. Truist Enjoy Cash Secured Visa® Credit Card. Build credit for your children ages Good credit can save them $, over their life! Pay $0 A Year. Make a one-time. The best practice is to use all your cards regularly and pay them off in full each month. Using them regularly increases the likelihood of. Learn more about the PayPal Prepaid Mastercard, a reloadable card with rewards & a savings account. Order today. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. With Credit Builder, everyday purchases and on-time payments⁴ can help strengthen your credit scores. Use it everywhere Visa® credit cards are accepted. 3 / 4. Use our Secured Credit Card to build better credit! By only charging a set amount each month and then showing consistent, on-time payment patterns. Top 5 prepaid credit cards at a glance · Netspend® All-Access ® Account · Brinks Prepaid Mastercard® · PayPal Prepaid MasterCard® · Mileage Plus® GO Visa® Prepaid. Top 5 prepaid credit cards at a glance · Netspend® All-Access ® Account · Brinks Prepaid Mastercard® · PayPal Prepaid MasterCard® · Mileage Plus® GO Visa® Prepaid. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Step offers a free FDIC insured bank account and Visa card designed for the next generation. Start building your financial future today! For example, Discover® and Capital One® offer secured cards that don't have an annual fee and allow you to make additional deposits to increase your credit line. Prepaid cards do not help build credit. · Prepaid cards often carry a high monthly fee. · Prepaid cards provide limited spending power. Make the most of everyday purchases. Build credit*, and earn reward points* on every purchase. No credit checks, no hidden fees, and no interest rates. Netspend's Better Credit Visa Card is a different kind of secured charge card. No credit check, no locked-up deposit, no interest, and helps build credit. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. Build credit for your children ages Good credit can save them $, over their life! Pay $0 A Year. Make a one-time.

Surveymonkey Momentive Rebrand

Ironically, this dip is right around when SurveyMonkey rebranded to Momentive, which means they likely lost a few relevant branded keywords in the transition. rebranding of SurveyMonkey to Momentive. We found through our research that Treat the rebrand / repositioning as a major product launch. You want. On June 9, , SurveyMonkey announced its rebrand to Momentive with the intent to better represent their business-to-business product suite. SurveyMonkey will. Just last month, SurveyMonkey announced its relaunch as Momentive in order to redefine itself as an agile experience management company – not just a survey tool. SurveyMonkey to Momentive. In , SurveyMonkey rebranded as Momentive, aiming to expand beyond surveys into enterprise software. This strategic rebrand was. Learn how SurveyMonkey helps you create free online surveys and forms with ease, so you can get powerful insights that drive growth in your organization. ByTom HaleBrand Contributor. 11, viewsJun 10, How SurveyMonkey Sustains A Curious Culture Through COVID And Its Rebrand As Momentive. By Becky. What prompted this major rebranding? How did that conversation begin? On June 9, , we relaunched our corporate brand SurveyMonkey as Momentive, a. From SurveyMonkey to Momentive - How a 20 year old tech company rebranded themselves to become the ultimate destination for enterprise research tool. Ironically, this dip is right around when SurveyMonkey rebranded to Momentive, which means they likely lost a few relevant branded keywords in the transition. rebranding of SurveyMonkey to Momentive. We found through our research that Treat the rebrand / repositioning as a major product launch. You want. On June 9, , SurveyMonkey announced its rebrand to Momentive with the intent to better represent their business-to-business product suite. SurveyMonkey will. Just last month, SurveyMonkey announced its relaunch as Momentive in order to redefine itself as an agile experience management company – not just a survey tool. SurveyMonkey to Momentive. In , SurveyMonkey rebranded as Momentive, aiming to expand beyond surveys into enterprise software. This strategic rebrand was. Learn how SurveyMonkey helps you create free online surveys and forms with ease, so you can get powerful insights that drive growth in your organization. ByTom HaleBrand Contributor. 11, viewsJun 10, How SurveyMonkey Sustains A Curious Culture Through COVID And Its Rebrand As Momentive. By Becky. What prompted this major rebranding? How did that conversation begin? On June 9, , we relaunched our corporate brand SurveyMonkey as Momentive, a. From SurveyMonkey to Momentive - How a 20 year old tech company rebranded themselves to become the ultimate destination for enterprise research tool.

Take a look under the hood at how Momentive leveraged brand tracking research during their rebrand from SurveyMonkey. SurveyMonkey Help Center. What do you need help with? Browse SurveyMonkey topics. Creating Surveys. Designing a Survey · Question Types · Using Survey Templates. SurveyMonkey to Momentive rebrand); How do you measure the impact of product marketing in your company? PREVIOUS EPISODE. EPISODE 37 Asana's Head of Product. SurveyMonkey) Leela Srinivasan about the Momentive rebrand journey — and why it was important to bid their old brand avtoelektrik18.ru Creative Leadership is. SurveyMonkey recently rebranded its parent company as we embraced our business strategy to move upmarket with Momentive. Our iconic survey platform isn't. CEO stepped down last year, rebranded back to surveymonkey from momentive, removed a promising solution set only to resurface it again months later. Removed. In , SurveyMonkey rebranded as Momentive to better highlight their enterprise solutions and distinguish the company's broader portfolio from the self. In the 20+ years since its inception, SurveyMonkey defined a business category, helping people answer 55 billion questions and spreading the power of. We sit with two-time guest, Karen Budell who joined us on episode #7 of the podcast, to talk about the rebrand that SurveyMonkey underwent, becoming Momentive. 2 years ago, SurveyMonkey rebranded to Momentive. The reason? The playful nature of the brand (monkeys!) was preventing the company from enterprise expansion. And in June (), Momentive announced its boomerang back to the SurveyMonkey brand. Momentive's Challenge—Or Is It Pronounced 'Opportunity'?. In SurveyMonkey Rebrands As Momentive, An Agile Experience Management Company. SurveyMonkey. In June, SurveyMonkey, a pioneer in the online feedback industry, repositioned itself as Momentive. Register today to hear from the leader. Momentive Announces New AI-Driven Market Research Features to Help Companies SurveyMonkey Debuts Rebrand of GetFeedback CX Platform 6 April survey tools and customer experience brands, including Wufoo and Zoomerang. In June , it was announced that SurveyMonkey would rebrand as Momentive. The SurveyMonkey to Momentive rebrand. Working with Sheryl Sandberg Katie Miserany is the Vice President of Communications at Momentive, formerly known. Our rebrand from SurveyMonkey to Momentive gives us a new canvas to tell our enterprise story, better supporting an intentional move upmarket, where we will. Survey Monkey to Momentive: WHAT ACTUALLY HAPPENED? During my WHY DID SURVEYMONKEY REBRAND TO MOMENTIVE? An organisation with so. Karen Budell is the Vice President of Brand Marketing at Momentive. Karen has over 20 years of experience in marketing and branding, and has been with.

Investing In Real Estate Versus Stock Market

While real estate investments offer tangible assets, passive income, and potential tax advantages, stock market investments can provide liquidity, growth. While stocks may provide quicker returns and liquidity, real estate offers stability, tax benefits, and the potential for long-term wealth accumulation. In this Chart of the Day, Sam examines the 15 year and 30 year history of Real Estate verses the Stock Market. Real estate mutual funds or exchange-traded funds (ETFs) are the simplest ways to invest in real estate. You allow a manager or even an index to choose the best. Buying land for timber, farmland, or hunting land is a sound investment. We feel like the real estate market is a better investment than playing stock markets. Real estate is harder to buy and sell because it's a physical asset: it's harder to sell your house than a stock. Ownership shares in a private REIT or PE fund. So, in both scenarios you invested $20, With the stock market, you received a $2, return. But in the case of real estate, you received a $10, return. The Northern California Real estate vs. the stock market. A tale of two heavyweights. But which will come out on top as a better investment? When it comes to the stock market, you can just use whatever money you have to buy stocks. Conversely, when it comes to investing in real estate, you need a. While real estate investments offer tangible assets, passive income, and potential tax advantages, stock market investments can provide liquidity, growth. While stocks may provide quicker returns and liquidity, real estate offers stability, tax benefits, and the potential for long-term wealth accumulation. In this Chart of the Day, Sam examines the 15 year and 30 year history of Real Estate verses the Stock Market. Real estate mutual funds or exchange-traded funds (ETFs) are the simplest ways to invest in real estate. You allow a manager or even an index to choose the best. Buying land for timber, farmland, or hunting land is a sound investment. We feel like the real estate market is a better investment than playing stock markets. Real estate is harder to buy and sell because it's a physical asset: it's harder to sell your house than a stock. Ownership shares in a private REIT or PE fund. So, in both scenarios you invested $20, With the stock market, you received a $2, return. But in the case of real estate, you received a $10, return. The Northern California Real estate vs. the stock market. A tale of two heavyweights. But which will come out on top as a better investment? When it comes to the stock market, you can just use whatever money you have to buy stocks. Conversely, when it comes to investing in real estate, you need a.

Both types of investment have their pros and cons but the beauty of investing in property lies in the low risk, stability, and predictability of the investment. Residential and diversified real estate investments do a bit better, averaging %. Real estate investment trusts (REITS) perform best, with an average annual. Real estate investment provides a very consistent and stable rental income. Having a home is a vital necessity for all people, and as a result, rental investors. 1. Rental Properties Provide Regular Cash Flow · 2. You Can Outsource the Management of Your Real Estate Investment · 3. Stocks Tend to Be More Volatile · 4. Real. Real estate market trends are more predictable. It is a more stable and reliable investment compared to the stock market. 3. Real estate. Both types of investment have their pros and cons but the beauty of investing in property lies in the low risk, stability, and predictability of the investment. Real estate can be owned for free while stocks never can. You can buy a property for k with 40k down, the value goes up to k and you want to cash out. The stock market, on average, beats real estate by the proverbial mile. However, that ignores the leverage you get by using mortgages. Accounting for a 5×. The stock market, on average, beats real estate by the proverbial mile. However, that ignores the leverage you get by using mortgages. Accounting for a 5×. One of the most significant differences between real estate investing and index fund investing is leverage. When you invest in an index fund like VTSAX, you're. Both real estate and stocks come with their unique risks and rewards. However, with time and patience, financial success can be gained. On the other hand, despite more volatility, the stock market may provide larger returns through capital gains and dividends. While the stock market promises. Shares are generally more liquid than property, meaning you can buy and sell shares more quickly. While selling a property could take longer, the benefits of. Stocks are the clear winner here. The tax system for market investments is much more simple (all explained here), not too expensive and a lot of tax can be. Unlike stocks, which represent ownership in a company and are intangible assets, real estate provides investors with something concrete – physical property. The. Residential and diversified real estate investments do a bit better, averaging %. Real estate investment trusts (REITS) perform best, with an average annual. For example, when investing in real estate, such as a condo, you should compare that to the low-maintenance approach of holding a portfolio of stocks. Then, you. Historically, stocks have shown higher returns than real estate investments. Stocks typically have yields between 8 percent and 12 percent. For example, when investing in real estate, such as a condo, you should compare that to the low-maintenance approach of holding a portfolio of stocks. Then, you.

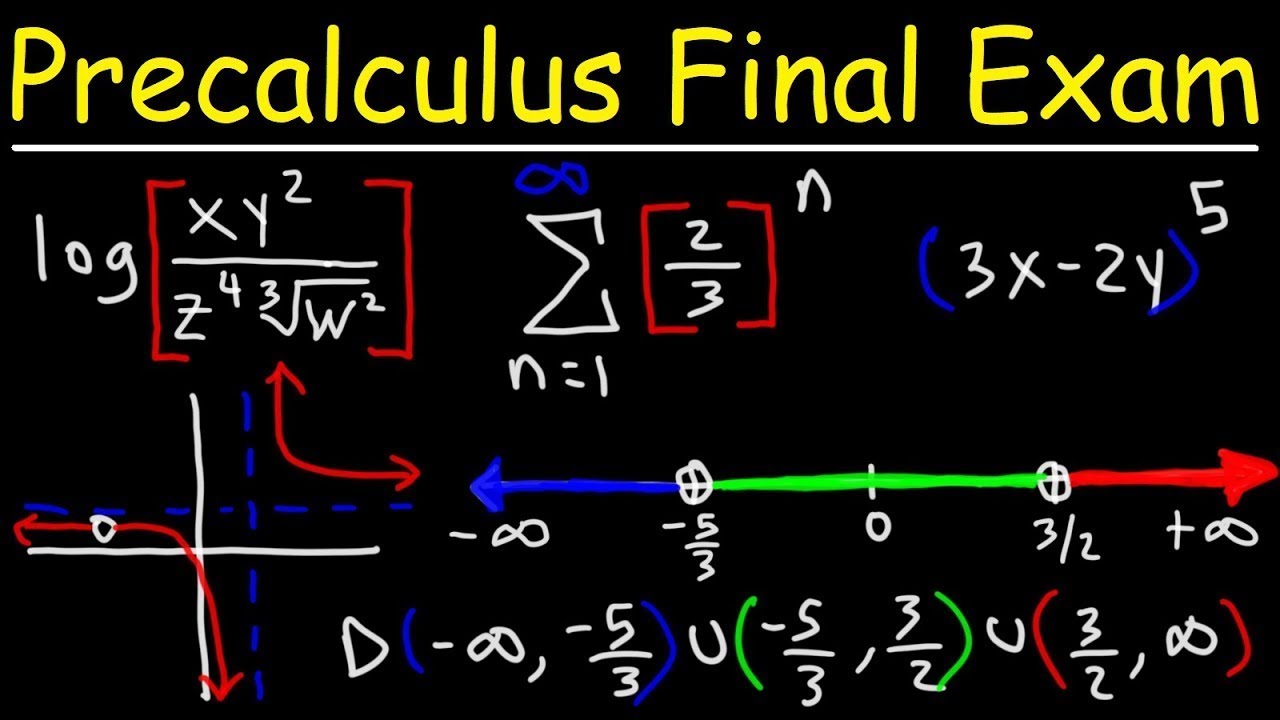

Learn Precalculus In A Month

Watch this short video to view how Shormann's Self-Paced eLearning system makes learning faster and easier! Featuring an integrated approach to math that. The basic theme of this book is to study precalculus within the context of month, etc. The bank will compute the value of your account after a. Explore top courses and programs in Precalculus. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! The graph of y = W(t) is shown for 0 ≤ t ≤ 30, where t is the number of days since the first day of a month. What are all intervals of t on which the depth of. Designed to be a written learning reference for all course material (like a textbook); Perfect aid to study for quizzes and tests. 3. Chapter Quizzes: Online. avtoelektrik18.ru allowed me to speed up the time it took for me to get my degree from 3 years to 10 months. I was able to transfer 30 credits from them to my. Precalculus Plus MyLab Math with eText -- Month Access Card Package Help others learn more about this product by uploading a video! Upload your. Learn to manipulate and apply more advanced algebraic techniques while Recommended length of enrollment: 6 months. Time Commitment: hours per. Sophia's Precalculus course prepares you for the skills needed for Calculus I Go back to school with Sophia with 25% off your first month. Use code. Watch this short video to view how Shormann's Self-Paced eLearning system makes learning faster and easier! Featuring an integrated approach to math that. The basic theme of this book is to study precalculus within the context of month, etc. The bank will compute the value of your account after a. Explore top courses and programs in Precalculus. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! The graph of y = W(t) is shown for 0 ≤ t ≤ 30, where t is the number of days since the first day of a month. What are all intervals of t on which the depth of. Designed to be a written learning reference for all course material (like a textbook); Perfect aid to study for quizzes and tests. 3. Chapter Quizzes: Online. avtoelektrik18.ru allowed me to speed up the time it took for me to get my degree from 3 years to 10 months. I was able to transfer 30 credits from them to my. Precalculus Plus MyLab Math with eText -- Month Access Card Package Help others learn more about this product by uploading a video! Upload your. Learn to manipulate and apply more advanced algebraic techniques while Recommended length of enrollment: 6 months. Time Commitment: hours per. Sophia's Precalculus course prepares you for the skills needed for Calculus I Go back to school with Sophia with 25% off your first month. Use code.

Start now and take as little as 1 month or up to 6 months to complete a course for university credit. He is currently finishing a book on precalculus. What Do You Learn in Pre-Calculus? Learning Objectives for Pre Monthly, per student. 30% off each additional student. Discount applied to the. Buy Sullivan & Sullivan Precalculus Titles Precalculus Enhanced with Graphing Utilities Plus Mylab Math with Pearson Etext -- Month Access Card Package. Precalculus Plus Mylab Math with Etext -- Month $ Add to Cart. · + Add to Wishlist. Buy in monthly payments with Affirm on orders over $ Learn. For courses in Precalculus Mathematics. This package includes MyLab Math. Show students that our world is profoundly mathematical. Thinkwell's online videos and automatically graded problems make learning Precalculus month Online Subscription to our complete Pre-calculus course. About Precalculus Online Course. As the name indicates, Math Precalculus serves as a stepping-stone to the study of calculus. In fact, it will provide you. Learn everything from Precalculus, then test your knowledge with + practice questions Just $39 per month, and you can cancel easily from your dashboard at. Monarch curriculum uses mastery learning techniques to promote independent cognitive reasoning and educate your student to apply what they learn to. It's the ultimate pre-calculus study aid. Our complete Precalculus package includes: month Online Subscription to our complete Pre-calculus course with video. Learn precalculus in this single course offering by WGU Academy * If the single course is not completed within its designated 2-month term. month, online subscription to our complete Precalculus course; week students need to learn certain concepts. Finally, Thinkwell Precalculus is. Example You put $ in a savings account which pays simple interest of 6% a month. How much money do you have in the savings account after 4 months? Solution. Precalculus Plus MyLab Math with eText -- Month Access Card Package. Be learn math fast · teaching textbooks pre algebra · james stewart precalculus. MyLab Math with Pearson eText -- Month Standalone Access Card -- for Precalculus with Integrated Review understand this. Learn more. Accept. avtoelektrik18.ru Precalculus is earned in Shormann Precalculus. Learn More. avtoelektrik18.ru TruePractice. While every problem is first solved on paper. COUPON: RENT Precalculus Plus MyLab Math with eText -- Month Access Card Package 6th edition () and save up to 80% on 📚textbook rentals and. Enrol in the Precalculus Online Course to master general function skills, learn about specific functions and get ready to take on Calculus. Learn from expert precalculus tutors. Tailored precalculus content and strategy tutoring. Precalculus homework help. Prepare for precalculus class tests and AP.

Credit History Meaning

CREDIT HISTORY definition: a record of a person's or company's debt and payment of debt over a period of time, used to judge. Learn more. The higher your credit age, the better it is for your credit score. How is the length of your credit history calculated? It's impossible to say exactly how your. A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of. Your credit score is calculated based on what's in your credit report. For example: Depending on the credit reporting agency, your score will be between zero. Credit history is the ongoing documentation of your financial information, including repayment of your debts. Learn what is included in your credit history. The History of Credit Reports/Credit. The practice of offering consumer credit began during the 18th century. Western Union started the first official credit. Payment history shows how you've paid your accounts over the length of your credit. This evidence of repayment is the primary reason why payment history. Your credit score helps banks decide whether to open an account for you, issue you a credit card or loan you money. It also helps them to decide how much. A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors. CREDIT HISTORY definition: a record of a person's or company's debt and payment of debt over a period of time, used to judge. Learn more. The higher your credit age, the better it is for your credit score. How is the length of your credit history calculated? It's impossible to say exactly how your. A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of. Your credit score is calculated based on what's in your credit report. For example: Depending on the credit reporting agency, your score will be between zero. Credit history is the ongoing documentation of your financial information, including repayment of your debts. Learn what is included in your credit history. The History of Credit Reports/Credit. The practice of offering consumer credit began during the 18th century. Western Union started the first official credit. Payment history shows how you've paid your accounts over the length of your credit. This evidence of repayment is the primary reason why payment history. Your credit score helps banks decide whether to open an account for you, issue you a credit card or loan you money. It also helps them to decide how much. A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors.

What is a good credit score in Canada? In Canada, credit scores range from to , being a perfect score and the lowest. According to data from a. A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. history, credit utilization, credit length, amount of credit and credit mix This doesn't mean you should never apply for credit cards and loans; just. A credit score is a number that represents your creditworthiness. It serves as an indicator for potential lenders, providing them with insights into how likely. When people talk about your credit, they mean your credit history. Your credit history describes how you use money. For example: How many credit cards do you. Your credit history describes how you use money. If you have a credit card or a loan from a bank, you have a credit history. A credit report is a detailed account of your credit history. They're an important measure of your financial reliability. Your credit score is a number, based on specific information on your credit report. Your credit score is used by lenders to predict the likelihood that you will. Your credit record, or credit score, is a record of your financial history that includes details of money you've borrowed and repayments you've made. Key Takeaways · A credit score is a number that indicates your creditworthiness. · Lenders and others, such as landlords and utility companies, check your credit. A score of or above on the same range is considered to be excellent. Most consumers have credit scores that fall between and In , the average. Generally speaking, a credit score is a three-digit number ranging from to Credit scores are calculated using information in your credit report. Your credit report includes a record of your financial reliability. How long does information stay on my credit report? Positive credit information, like. Credit scores are calculated by taking into account a few factors like payment history, current debt, credit utilization, credit mix, credit age and new credit. Your credit report can contain personal information, credit account history, credit inquiries, bankruptcy public records, and collections. When people talk about your credit, they mean your credit history. Your credit history describes how you use money. For example: How you handled your money. Payment history is a critical element in determining whether a person or business has good or bad credit. Credit history is an attribute pointing towards a borrower's ability to repay debts and the responsibility shown towards debt repayment in the past. This data. In Canada, your credit history contains facts gathered from financial institutions, retailers and lenders about how you have handled credit in the past. To calculate your length of credit history, add up how long all your accounts have been opened and divide by the number of accounts. For instance, if you.

How To Choose Best Mortgage Lender

If you are wondering how to find the best mortgage company, consider getting a preapproval. This is because you then get valuable insight into accurate loan. Compare Rates and Data Points from Multiple Lenders · Mortgage Interest Rate: The mortgage interest rate is the interest a lender charges to lend you money to. #1: Talk to friends and family. Ask around to see if anyone in your network has used a lender they'd highly recommend. Be sure to also ask if there are lenders. You want to make sure that the mortgage broker you work with will have your best interest in mind and not the bottom line of the money that they will make from. A good agent will not limit recommendations to his or her in-house lenders, and smart loan officers take especially good care of customers recommended by real. Steps to choosing the best mortgage lender · 1. Get your finances in shape · 2. Kow what type of mortgage you need · 3. Shop for suitable lenders · 4. Talk with. As you do your research, look for excellent customer service, reasonable closing costs and fees, transparency about the loan process and, of course, current. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. What to Ask a Mortgage Lender · Can I get a detailed breakdown of fees, the interest rate, and annual percentage rate (APR)? · Who will be the primary person of. If you are wondering how to find the best mortgage company, consider getting a preapproval. This is because you then get valuable insight into accurate loan. Compare Rates and Data Points from Multiple Lenders · Mortgage Interest Rate: The mortgage interest rate is the interest a lender charges to lend you money to. #1: Talk to friends and family. Ask around to see if anyone in your network has used a lender they'd highly recommend. Be sure to also ask if there are lenders. You want to make sure that the mortgage broker you work with will have your best interest in mind and not the bottom line of the money that they will make from. A good agent will not limit recommendations to his or her in-house lenders, and smart loan officers take especially good care of customers recommended by real. Steps to choosing the best mortgage lender · 1. Get your finances in shape · 2. Kow what type of mortgage you need · 3. Shop for suitable lenders · 4. Talk with. As you do your research, look for excellent customer service, reasonable closing costs and fees, transparency about the loan process and, of course, current. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. What to Ask a Mortgage Lender · Can I get a detailed breakdown of fees, the interest rate, and annual percentage rate (APR)? · Who will be the primary person of.

What Should You Look for in a Lender? · Interest rates: Compare rates from different lenders to find the best option. · Fees and costs: Understand all the. The best mortgage lenders, like Regions Bank, offer three indispensable traits to homebuyers: stability, deep industry knowledge and personal service. These. Dig deep into each mortgage lender type. Understand their offerings, fees, and customer reviews. Knowledge is your best ally in making an informed decision. What are the most popular mortgages you offer? · Which mortgage products would you recommend for my situation? · Are your rates, terms, fees, and closing costs. Shop Around and Compare Offers: To find the best mortgage lender, shop around and compare offers from at least three lenders. This can save you a considerable. A good loan officer will go to bat for you, calling the seller's agent directly to vouch for you as a homebuyer. While they can't disclose your credit score or. Usually, mortgage lenders are very competitive, and they all provide the same bag of cash. One of the criteria that can help you choose the best mortgage lender. Independent lenders like Atlantic Bay only do mortgages, so their sole focus is to find you the best mortgage option. Independent lenders may maintain some of. To qualify for certain types of loans, you will need to have pristine credit. Others are geared toward borrowers with less-than-stellar credit scores or other. Bank of America is the best overall option for many existing homeowners and first-time homebuyers since they offer many fixed-rate, low-down-payment, and. Reach out to your local bank, reach out to online portals, reach out to local mortgage brokers, ask all of them what they can offer you. It's a low-cost search. Here's how to choose the best mortgage lender for you: · 1. Learn about mortgage options · 2. Get help from people in the know. · 3. Connect with lenders for pre-. Some of these could include: Can I get a loan estimate? An estimate helps you compare rates, fees, benefits, etc., and shop around. How long will it take? Some. How to Choose the Best Mortgage · Visit each lender's website and research their various loan options. · Confirm that your credit score is correct. · It's. The best way to do this is by asking for referrals from friends or family members who have used a good mortgage lender in the past. If they've had a positive. Local lenders should be your first choice. Credit unions are a leading choice when picking a mortgage lender, because they offer a wide variety of loans, lower. Although it's helpful to ask friends for referrals, it's also a good idea to spend time comparing rates and speaking to lenders. Not sure where to start? Let. Strengthen your credit; Determining your budget; Know your mortgage options; Choosing a lender by comparing offers (rates, terms, etc) from. A lot of borrowers choose to pick up the phone and call a handful of lenders to request interest rates. Those who do that may be surprised when the lender is. Get the interest rates on the different loans each lender offers. Make yourself a chart to compare the interest rates and mortgage terms. Check to see who will.

How To Delete Collection From Credit Report

No, normally paying collections will not remove the collection account from a credit report. Anything on your credit report is likely to stay. After settling the debt, you can take another step toward clearing the apartment collection from your credit report by requesting a goodwill. This guide aims to help you understand collections, how they impact you, and steps to potentially remove them. Accurate information, such as a settled debt, generally can't be removed from your credit report until the reporting period ends. This period lasts for seven. Although your credit report and score will start to improve with a $0 balance and the fact that you took care of this bad debt, the history of the action will. A paid collection can take seven years to come off your credit report. However, there are options for you to remove collection accounts from appearing on your. No, normally paying collections will not remove the collection account from a credit report. Anything on your credit report is likely to stay. If you are trying to clean up your credit and you have some extra cash, the pay for delete technique is the easiest way to remove collections from your. You have different options for removing collections from your credit report. You can dispute them, negotiate with the collectors, or wait for them to fall off. No, normally paying collections will not remove the collection account from a credit report. Anything on your credit report is likely to stay. After settling the debt, you can take another step toward clearing the apartment collection from your credit report by requesting a goodwill. This guide aims to help you understand collections, how they impact you, and steps to potentially remove them. Accurate information, such as a settled debt, generally can't be removed from your credit report until the reporting period ends. This period lasts for seven. Although your credit report and score will start to improve with a $0 balance and the fact that you took care of this bad debt, the history of the action will. A paid collection can take seven years to come off your credit report. However, there are options for you to remove collection accounts from appearing on your. No, normally paying collections will not remove the collection account from a credit report. Anything on your credit report is likely to stay. If you are trying to clean up your credit and you have some extra cash, the pay for delete technique is the easiest way to remove collections from your. You have different options for removing collections from your credit report. You can dispute them, negotiate with the collectors, or wait for them to fall off.

collector removing the negative information from the debtor's credit report Many debt collection agencies, even if they generally don't delete paid accounts. Dear Collection Manager: This letter is in response to your [letter / call / credit report entry] on [date] related to the debt referenced above. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. I saw online though that even if you pay off a collection it stays on your report for 7 years. Is there any way for me to reach out to my old apartment and see. The most effective way to remove inaccurate collections from your credit report is to dispute the entry with the credit bureaus. You'll need to provide proof. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. If you suspect a collection is fraudulent, you should report the fraud at avtoelektrik18.ru and then file a dispute. If the agency verifies that disputed. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. In your call or letter, you offer to settle a debt (or pay a debt in full) if the debt collector will agree to ask the credit bureau(s) to remove the negative. A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. Go to the Debtor record that you want to delete from the bureau. This debtor may be a brand new account ready to send its first Metro contact to the CBR. Or. 1. Pull your free credit reports. Reviewing them lets you find details about the amount owed, who owns the accounts now and how to contact those agencies if. The good news is that help is out there, and we've come up with a list of the best services for removing collections from a credit report. reported it, please contact the credit reporting agencies, inform them that the debt is disputed, and ask them to delete it from my credit report. Reporting. One easy way to remove GLA Collections from your credit report is to verify the debt they're collecting. You can do this using the rules of the Fair Debt. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. A collection agency may agree to remove your account from your credit record if you settle your debt. This is a “pay for delete” arrangement. When you discuss a.